Financial Services Litigation

Financial Services Law Blog

Litigation is not late in challenging new CFPB Rule capping credit card late fees.

Financial Services Law Blog

Lenders Beware of Potential Litigation Stemming from Credit Decisions Based on AI

Financial Services Law Blog

After Years of Mortgage Escrow Limbo, National Banks Will Soon Learn Their Fate

Financial Services Law Blog

Lenders Beware: New Restrictions in Effect regarding Force-placed Insurance in Missouri

Financial Services Law Blog

Update: The Aftermath of the Fifth Circuit CFPB Holding

Product Liability Law Blog

The Impact of Mallory v. Norfolk Southern R. Co. in Illinois, Missouri & Kansas

Financial Services Law Blog

Western District refuses to dismiss coverage dispute after material change in circumstances.

Financial Services Law Blog

Holding the Purse and Wielding the Sword: The Fifth Circuit Finds CFPB's Funding Mechanism Unconstitutional

Financial Services Law Blog

Tenth Circuit Mandates "Reasonable Consumer" standard for FDCPA claims

Financial Services Law Blog

Secured Creditors of Missouri Get Some Guidance and Good News from the Missouri Supreme Court

Financial Services Law Blog

Arbitration Agreements Need Not Be Balanced

Financial Services Law Blog

Missouri Court Clarifies Issues of Prejudgment Interest Pre-2021

Illinois Law Blog

TRO Puts Illinois Judicial Circuit Redistricting to a Halt

Missouri Law Blog

The Pandemic Continues to Impact Kansas City Area Trials and Verdicts

Financial Services Law Blog

Significant 2021 Financial Services Industry Decisions and Legislation

Financial Services Law Blog

Update: Supreme Court Holds No Concrete Injury in FCRA Class Action Case

Financial Services Law Blog

FHFA Structure Declared Unconstitutional by SCOTUS

Financial Services Law Blog

Kansas Merchants May Soon Impose Surcharges on Credit Card Transactions

Financial Services Law Blog

Illinois' Predatory Loan Prevention Act Takes Effect

Missouri Law Blog

The Kansas City Area Saw Trials Plummet in 2020 Due to the Pandemic

Financial Services Law Blog

U.S. Supreme Court to Review FCRA Class Action Jury Verdict

Financial Services Law Blog

You Better Watch Out... for Scammers

Financial Services Law Blog

U.S. Supreme Court Rules CFPB Structure Unconstitutional

Employment & Labor Law Blog

Inaccurate Background Reports Concerning Job Applicants May Give Rise to Employer Liability under FCRA

Missouri Law Blog

Missouri House Approves Stricter Standards for Punitive Damages Claims

Financial Services Law Blog

Tips for Small Businesses Considering PPP Loan Relief

Kansas Law Blog

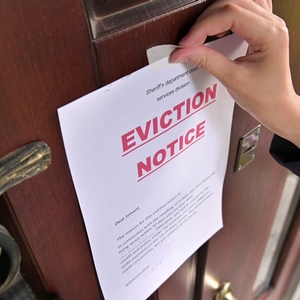

Kansas Temporarily Prohibits Foreclosures and Evictions

Financial Services Law Blog

CFPB Constitutionality Case Submitted to Supreme Court Today

Product Liability Law Blog

United States Supreme Court Holds Counterclaim Defendants May Not Remove Diverse Lawsuits

Missouri Law Blog

Hopping on the Missouri Bandwagon? Not so Fast Out-of-State Litigants.

Missouri Law Blog

City of St. Louis - Still A Judicial Hellhole

Financial Services Law Blog

Change in Leadership Marks Turning Point for CFPB

Financial Services Law Blog

Bitcoin, Bankers, and Barriers to Legislation

Financial Services Law Blog

Update - Senate Unwinds CFPB Arbitration Rule

Financial Services Law Blog

Swift Litigation Ensues Following Equifax Data Hack

Financial Services Law Blog

New CFPB Rule Prohibits Consumer Waiver of Class Action Litigation

Financial Services Law Blog

SCOTUS upholds narrow interpretation of "debt collector" under the FDCPA

Financial Services Law Blog

Financial CHOICE Act Garners Sufficient Votes in House Vote

Product Liability Law Blog

You've Got Mail - Service of Process by Mail is Satisfactory under the Hague Service Convention

Drug / Device Law Blog

Federal Judge Clobbers Claims in a Class III Medical Device Case

Financial Services Law Blog

Missouri Court Finds that Overdraft Fees are Money Well Spent

Kansas Law Blog

Reunited and it Feels so Good

Financial Services Law Blog

Community Banks Press On in Fight for Regulation Reform

Missouri Law Blog

The Daubert Standard - Coming Soon to a Missouri Court Near You

Product Liability Law Blog

Federal Judges Blow Their Stacks Over Boilerplate Objections

Financial Services Law Blog

CFPB Sets its Sights on Student Loan Servicing

Financial Services Law Blog

Favorable Ruling for Loan Servicers regarding Statute of Limitations

Financial Services Law Blog

Challenges Remain to Widespread Implementation of e-Mortgages

Financial Services Law Blog

FinCEN Issues New Advisory to Financial Institutions Regarding Reporting of Cyber-Events

Financial Services Law Blog

Structure of CFPB declared unconstitutional in PHH Mortgage holding

Financial Services Law Blog

Future of CFPB Uncertain under Trump Administration

Missouri Law Blog

SCOTUS Deadlock results in favorable outcome for Missouri bank

Kansas Law Blog

Kansas Courts Reluctant to Find Waiver of Arbitration

Kansas Law Blog

Prevailing-party agents entitled to attorney's fees

Product Liability Law Blog

In a differential etiology, experts need not rule out all possible causes

Kansas Law Blog

Punitive Damages Part 1: Don't Get Caught Flat-Footed

Kansas Law Blog

Kansas abolishes assumption of the risk defense.

Kansas Law Blog